A Backcasting Case Study: Tala

Marc Andreessen recently came out with a viral blog post called It’s Time to Build. In it, he calls out Americans for getting complacent and only striving to build incrementally better products. It’s a much needed rallying call.

Then a week later Mike Maples, a long time investor in Silicon Valley and founder of Floodgate, came out with his post on how to build the future. He took the high-level battle cry from Silicon Valley’s general and formulated a framework to break free from incremental improvements and to create a groundbreaking new tech or business. I’ve heard Mike talk about this on other platforms, and it’s really quite good.

In case you want to skip the read, it can be broken down like this:

If you live in the present, you will come up with solutions to current problems. These will be incrementally better and not a breakthrough.

You need to live in the future to create a breakthrough product.

He coined the term Backcasting which is the process of taking a future state and mapping back to the present in order to create a breakthrough.

Steps of Backcasting

Find an inflection point - a macro-level shift in society. This can be in the form of:

New technology

Mass adoption of something new

Shift in regulations

Change in widely held beliefs

Backcast from potential futures - From plausible to possible to preposterous. This step is designed to open up your thinking on all the different possibilities of the future.

Plausible - wouldn’t anticipate it, but sounds plausible once you hear it

Possible - an obsession that turns into a breakthrough

Preposterous - seems crazy to everybody

Gather breakthrough insights - This is a thought experiment that asks open-ended questions like:

What is less likely to happen than many believe?

What could happen with this inflection that is more likely than most believe?

What would be the best outcomes from this inflection that could realistically happen?

What is a preposterous potential future that might not be so crazy after all?

He wraps this up by saying you should surround yourself with fantastic people that also like in this future with you and begin to execute.

When I read this I asked myself - Is this right? Does it map back on my personal experience?

At first, I was skeptical so I decided to test this framework by trying to apply it to my experience building Tala.

Tala’s inflection point

Tala is a mobile credit scoring and lending company focused on emerging markets. You download the app, fill out a short loan application, and get the money sent directly to your mobile wallet. But that was not the original idea.

We originally thought that an SMS based accounting tool for micro-entrepreneurs would be the game changer the market was looking for. And after years of toiling around with this incremental improvement to the status quo, we realized two big shifts were happening:

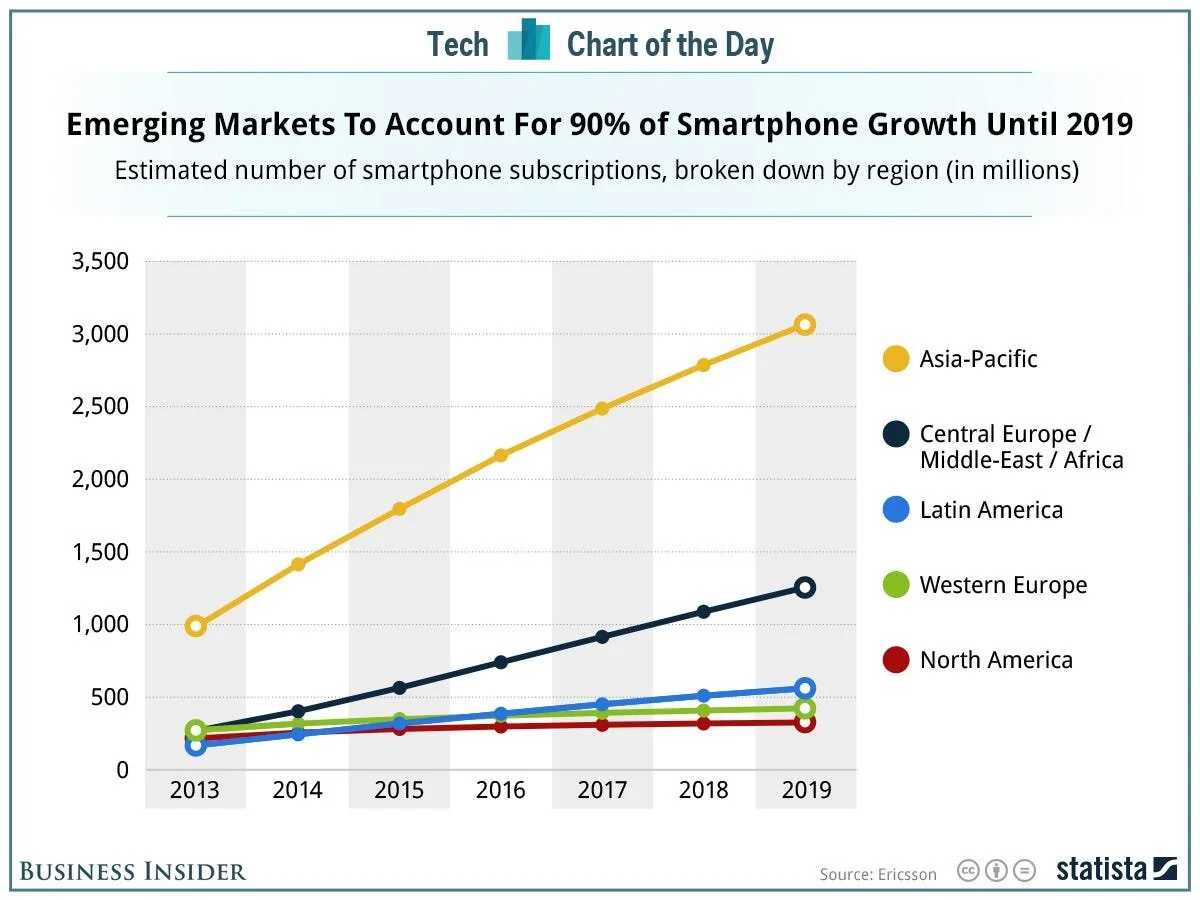

Smartphone adoption was rapidly growing in emerging markets.

This showed us we can still serve a large population by moving away from “dumb” phones

2. In the same markets, mobile money adoption was growing very quickly

We knew that we could get similar or better accounting information through this digitized source

Backcasting

Plausible, possible, or preposterous? I’m not sure Tala’s backcasting exercise falls so neatly in one of these areas. My guess would be in between plausible and possible.

Plausible: Let’s take the unstructured data on people’s phones, formulate behavioral insights, and build a credit model from the data.

Possible: Let’s use that credit model to provide them an unsecured loan and have them pay it back.

When we spoke to anyone in the market about the unsecured lending portion of this, the response was unanimous, “Oh that would never work in my country. People are very crafty and you will never get them to pay you back.”

This leads us to our insights.

Insights

While we never had a formalized approach to this conversation, we were lucky enough at Tala to have a uniquely experienced driven group of individuals working with us. So these conversations were natural and persistent which created a strong energy of innovation. Some responses we would have had to some of Mike’s questions were:

What is less likely to happen than many believe?

People will pay us back as we believe people are generally trustworthy.

What could happen with this inflection that is more likely than most believe?

Mobile money will grow beyond Kenya and become the money transfer rails of the under-banked.

What would be the best outcomes from this inflection that could realistically happen?

Financial services could be democratized and serve previously off the grid individuals

What is a preposterous potential future that might not be so crazy after all?

We could use this credit score as a basis for creating a ubiquitous digital identity.

These insights we had were not bound by time or the current problems of the financial system. They were future-looking and idealistic. They helped lay the groundwork to getting started on building.

Build

This is where I break away from Mike’s framework and take it one final step towards implementation. We were armed with unique insights about the future, a vision for where we wanted to go, and clear macro trends to harness. From here it’s about formulating and testing hypotheses.

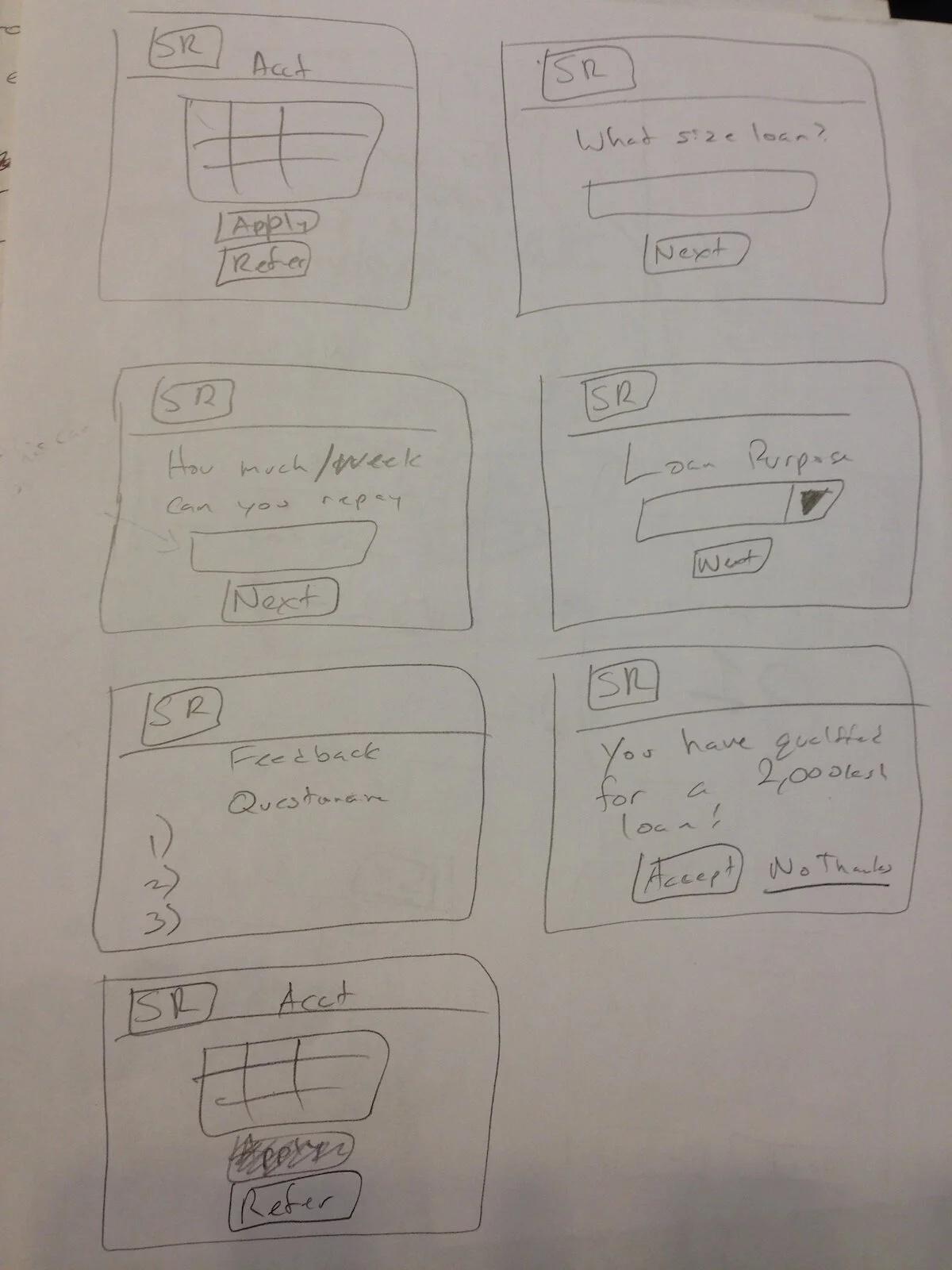

At Tala we decided to split the little resources we had from our operations in India, to build a lending app to see if we were on to something. We built an MVP this in two weeks with the following questions in mind:

Would people with smartphones download an app and provide permissions to read SMS data that showed mobile money receipts?

Could we harness machine learning to analyze this unstructured data and assess the creditworthiness of an individual, sight unseen?

Would people pay us back?

It turns out the answer is yes :) and a new market of digital lending was formed.

Original sketch of the Tala’s MVP called “Safari Rahisi” or “Easy Loan” in Swahili

Conclusion

I’ll admit, it’s much easier to backcast to an existing company’s successful trajectory. Having lived through this entire process it’s not so easy. The world is messy and being creative doesn’t necessarily have a framework. Tala’s path from an SMS accounting tool to creating a new, global digital lending market was anything but linear. It was haphazard, messy, and lucky.

But that’s not the point of Mike’s post. He’s trying to inspire entrepreneurs to break out of their mental limitations, build, and pull the rest of us into a bright and better future we can be excited about.

As New York Times bestselling author Kevin Kelly once said, “Over the long term, the future is decided by optimists. To be an optimist you don’t have to ignore all the many problems we create; you just have to imagine improving our capacity to solve problems.”